Recommendation Tips About Cash Flow Chart Excel

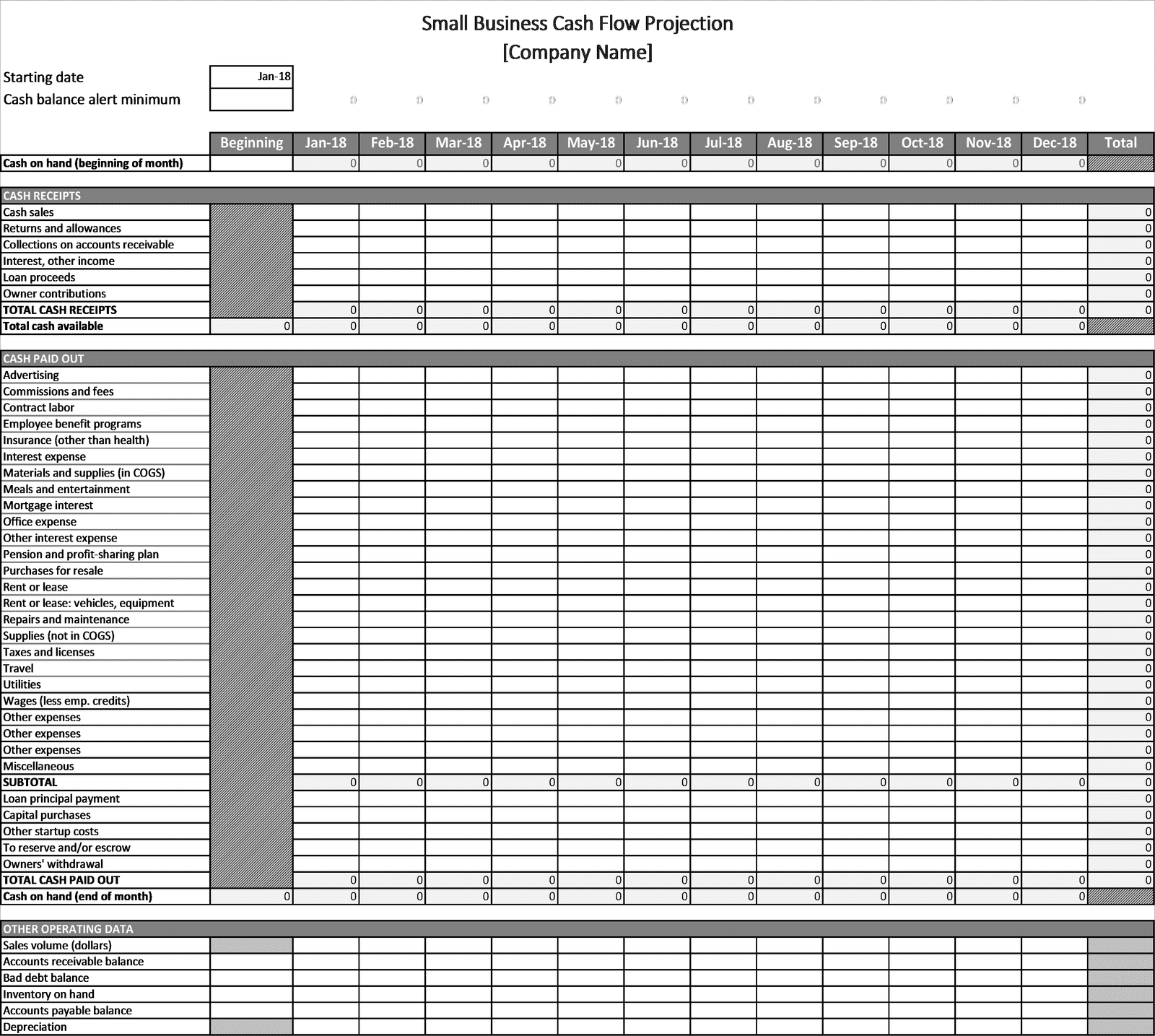

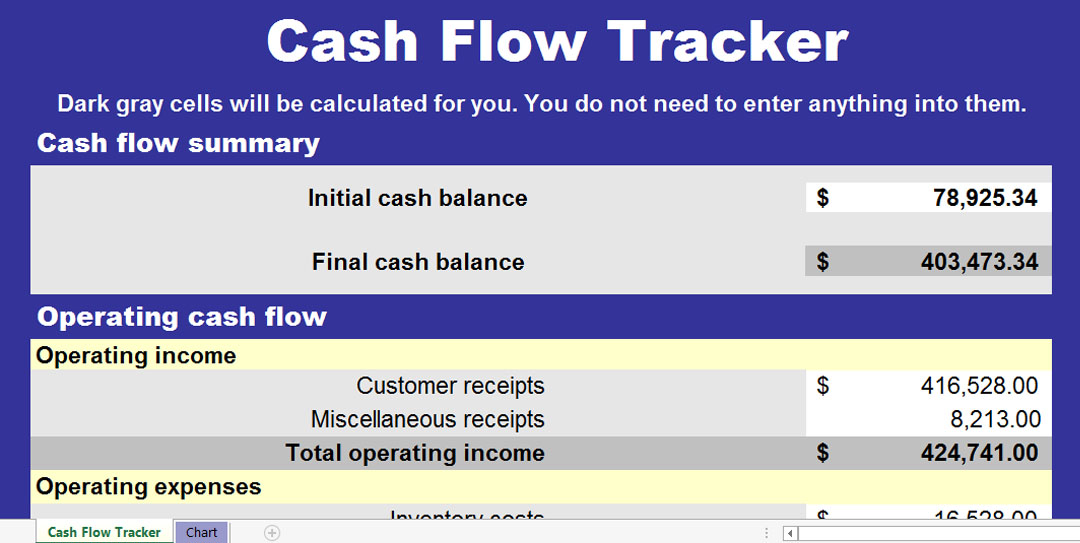

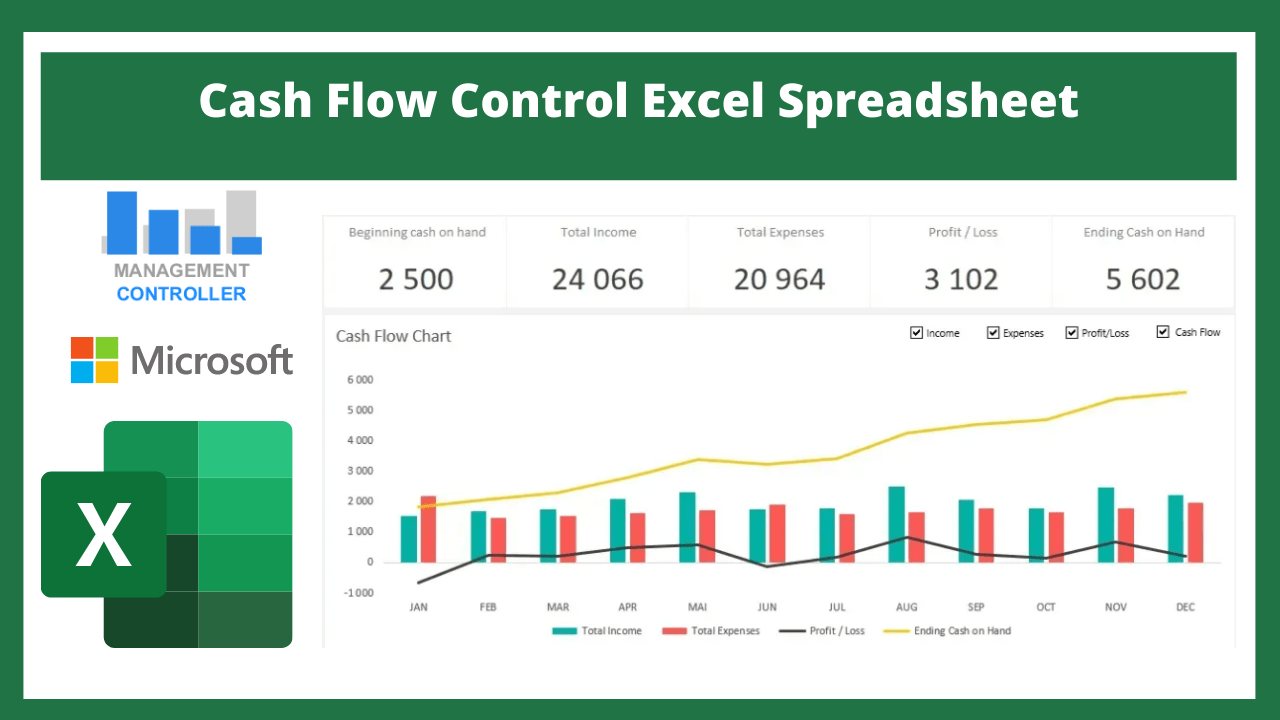

Use this basic cash flow template to compare your business cash flows against different time periods.

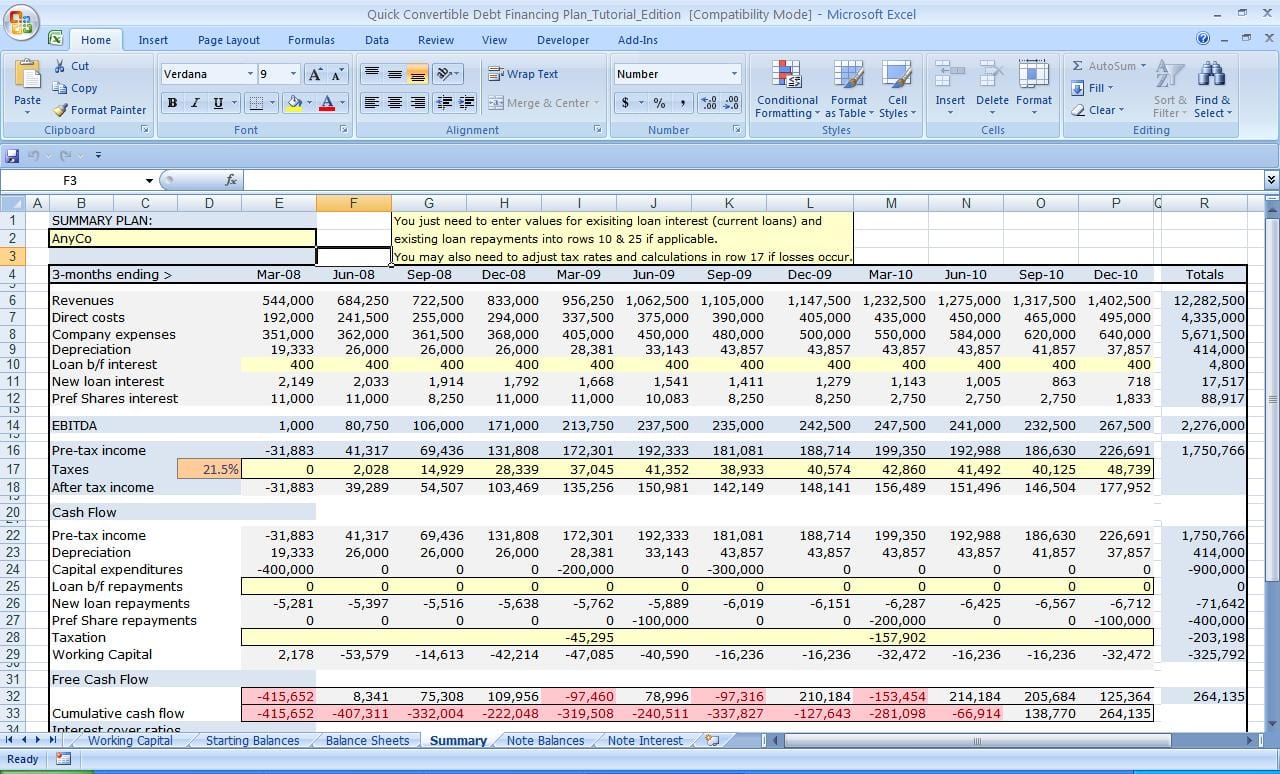

Cash flow chart excel. Financing activities financing activities include creditor borrowing and loan repayments, stock issuing and repurchasing, collecting investor/owner money, and cash dividend payments. Creating the cash flow diagram conclusion introduction welcome to the world of finance! Which cash flow visualization will you pick?

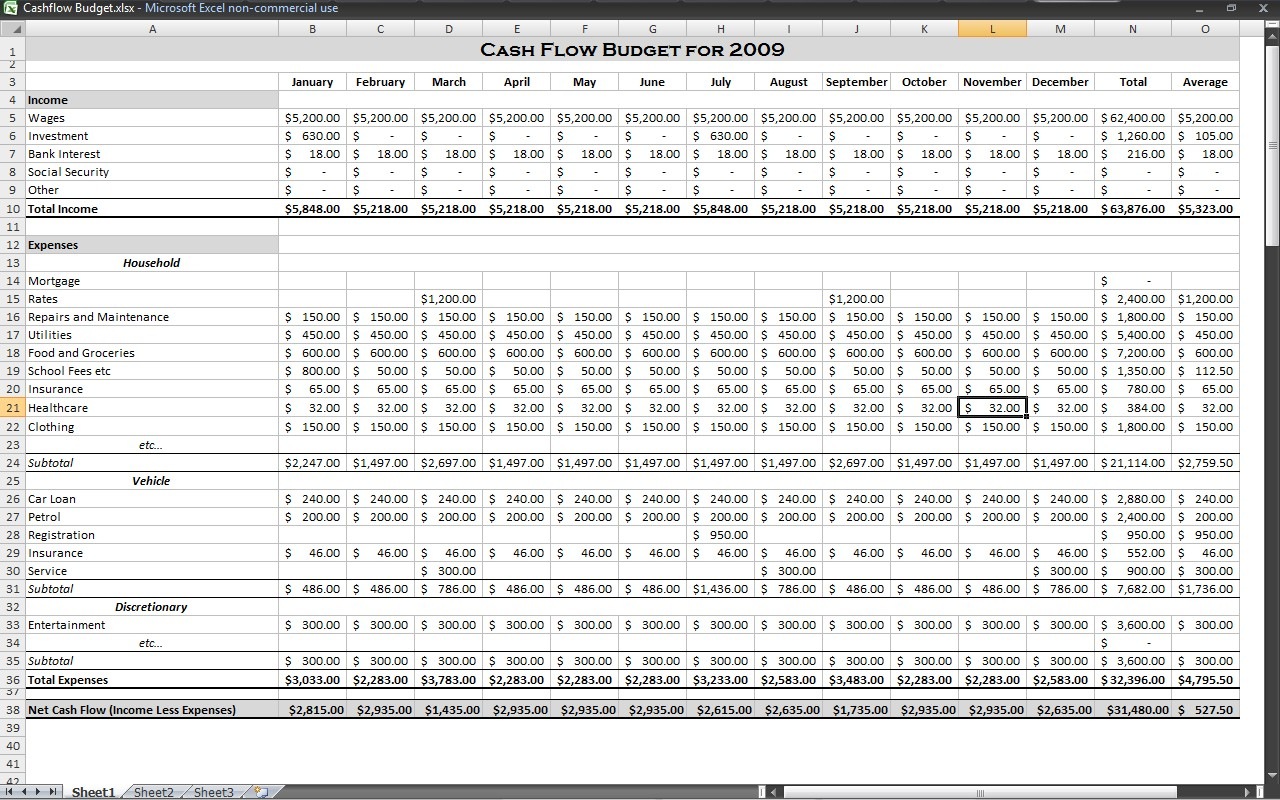

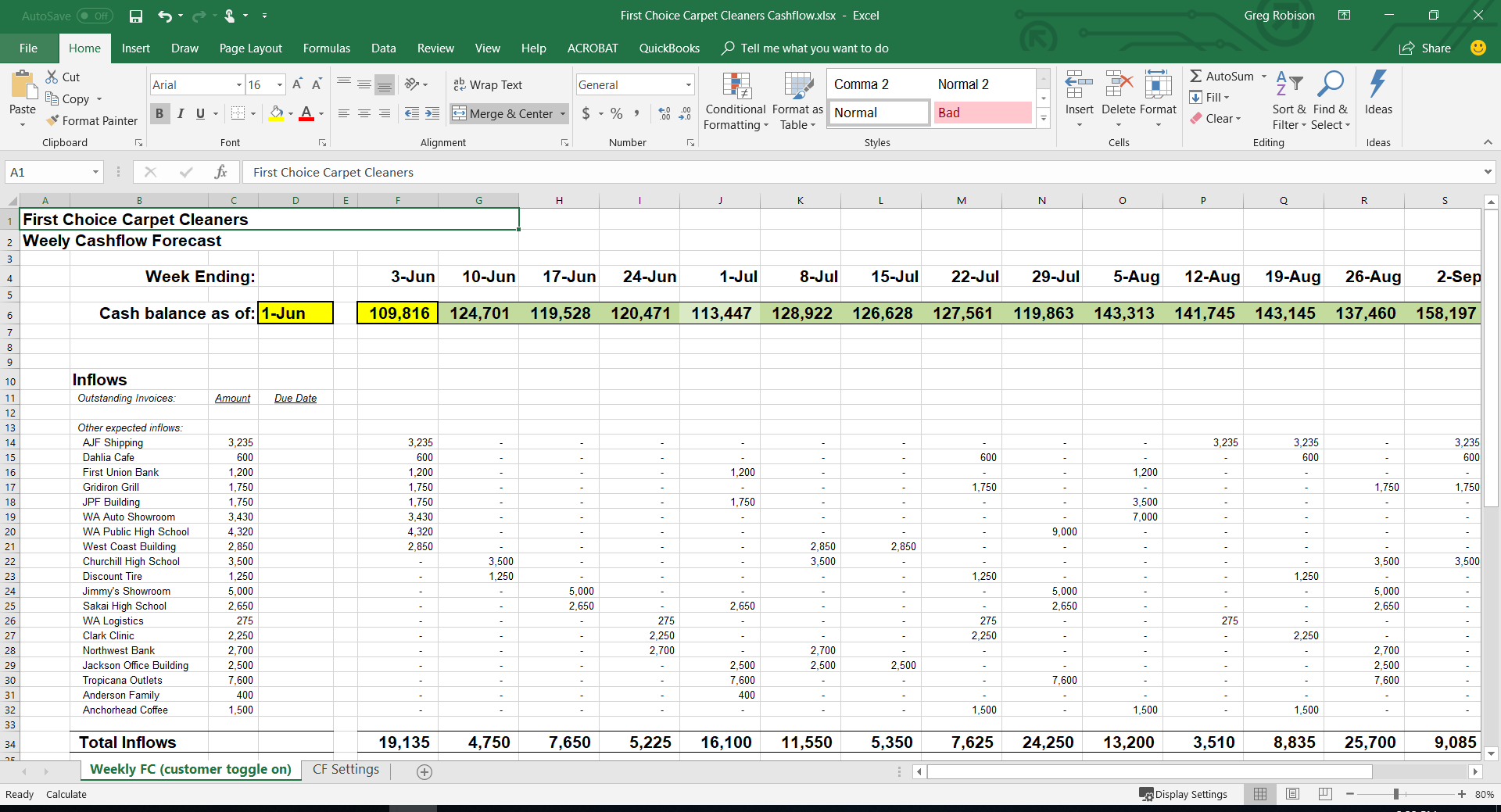

Cash flow is the net amount of cash and cash equivalents coming in and out of your business. A cash flow diagram in excel is a visualization that displays insights into the income and expenses in a specified time. But, you can choose to begin in other months (like january) if it's more convenient for you.

Manage your finances using excel templates. Entering the time periods step 4: Open microsoft excel and select “blank workbook” to create a new worksheet.

Entering the cash inflows step 5: To get started with our cash flow diagram generator (chartexpo), follow the simple steps below: Creating a cash flow chart in excel or google sheets.

Now select the cell again. Incremental cash flow is the extra money a business makes from starting something new. The sankeystartpillar table is reasonably easy to understand.

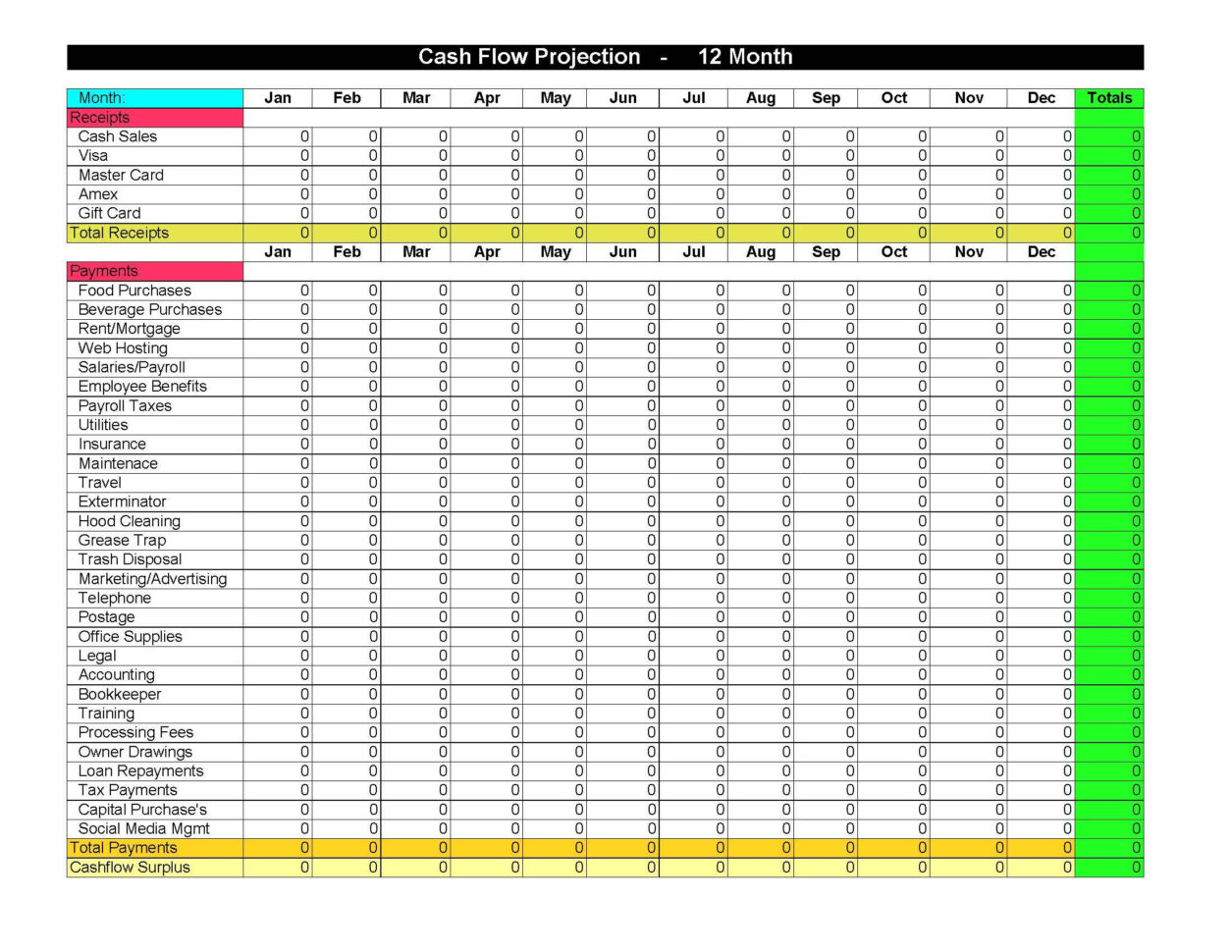

Choose from 15 free excel templates for cash flow management, including monthly and daily cash flow statements, cash projection templates, and more. Label the columns “cash inflows” and “cash outflows.” include a row for each period of time you want to analyze, such as months or quarters. The cash flow statement, or statement of cash flows, summarizes a company's inflow and outflow of cash, meaning where a business's money came from (cash receipts) and where it went (cash paid).

There exist different types of cash flow like annual, incremental, discounted, net, cumulative, and so on. In this article, we are going to focus on how to calculate cash flow in excel. Sudden market changes, government rules, and legal issues can affect incremental cash flow calculations.

A cash flow table is a spreadsheet view of cash inflows and outflows in a project or department that displays the net cash result of the activity at fixed intervals over a period of time. Next, you will get the following waterfall chart for the cash flow dataset. Download a statement of cash flows template for microsoft excel® | updated 9/30/2021.

Then go to insert >> insert waterfall, funnel, stock, surface, or rudder chart >> waterfall as shown below. It consists of three primary categories: It just needs each row category from the source data listed with a “blank” item in between.

Choose a period to cover cash flow statements are usually broken down into monthly periods. This figure helps managers decide if a project is worth investing in or not. Moreover, enter the beginning balance of cash on hand, and then detail itemized cash receipts, payments, costs of goods sold, and expenses.